|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

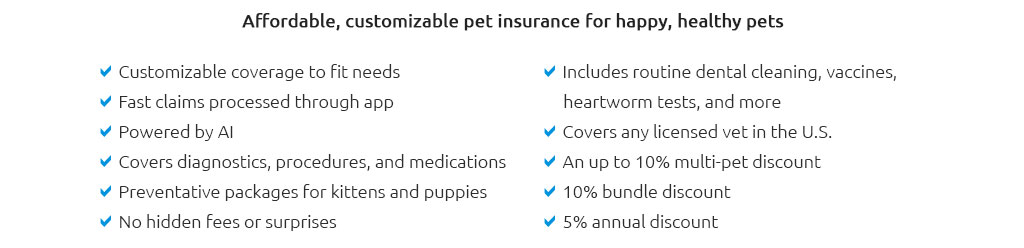

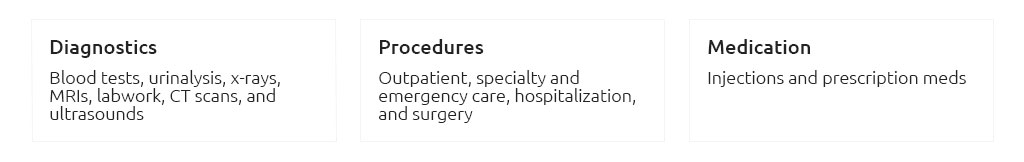

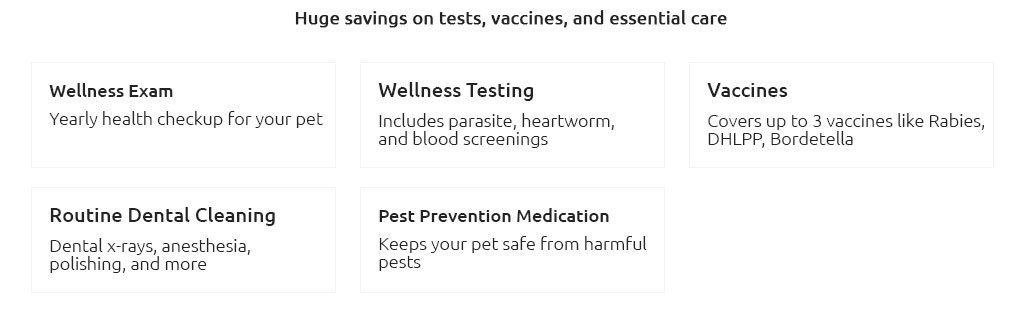

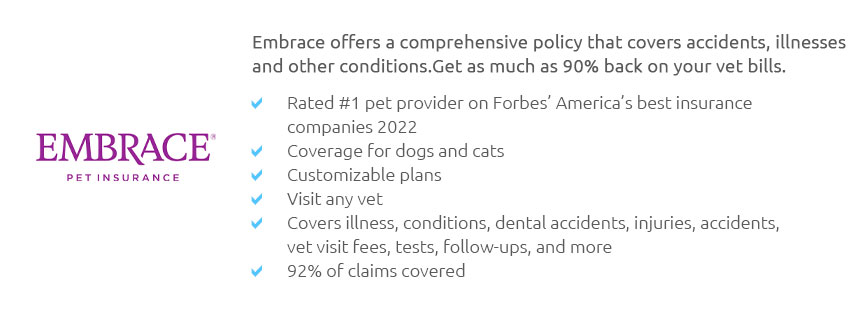

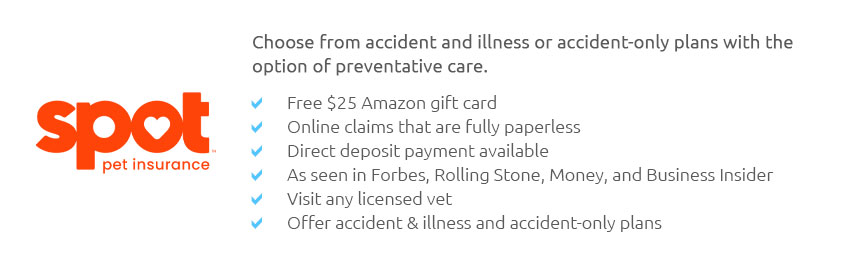

Understanding Dog Pet Insurance Plans: A Comprehensive GuideIn today's world, where dogs are often considered cherished members of the family, ensuring their health and well-being is paramount. Enter the realm of dog pet insurance plans-an essential safeguard for your beloved canine companion. With a myriad of options available, selecting the right insurance plan can seem daunting, yet it is a critical decision that can significantly impact both your pet's health and your financial peace of mind. This article aims to demystify the complexities of dog pet insurance, offering insights into its benefits, coverage options, and what to consider when choosing the best plan for your furry friend. Why Consider Dog Pet Insurance? For many pet owners, the thought of facing an unexpected veterinary bill is a daunting prospect. Whether it's a routine check-up or an emergency surgery, veterinary care can be costly. Dog pet insurance serves as a financial buffer, allowing you to focus on your pet's health rather than the expense. Investing in insurance not only protects your wallet but also ensures that your dog receives the necessary care without delay. Types of Coverage Available When exploring insurance plans, it's crucial to understand the different types of coverage available. Most providers offer basic coverage that includes accidents and illnesses, while more comprehensive plans may cover routine care, medications, and even alternative therapies. Accident-only policies are ideal for pet owners seeking a cost-effective option, covering unexpected injuries but excluding illnesses. On the other hand, comprehensive plans provide a broader safety net, encompassing a wide range of medical needs. The choice ultimately depends on your pet's specific health requirements and your financial considerations. Key Factors to Consider When selecting a dog pet insurance plan, several factors should be meticulously evaluated. First and foremost, consider the coverage limits and deductibles. Higher coverage limits typically mean higher premiums, but they offer greater financial protection. Additionally, assess the waiting periods imposed by the insurer, as some conditions may not be covered immediately after enrollment. Another vital aspect is the reimbursement model, which can be based on actual veterinary costs or predetermined benefit schedules. Finally, scrutinize any exclusions or limitations within the policy, as these can significantly impact your coverage. The Subtle Art of Choosing a Provider With numerous insurers vying for your attention, selecting the right provider can be overwhelming. Reputation and customer reviews can offer valuable insights into an insurer's reliability and customer service. Furthermore, consider the provider's experience in the pet insurance industry and their commitment to innovation and improvement. An ideal provider should offer transparent policies, a seamless claims process, and responsive customer support. Taking the time to research and compare providers can ultimately lead to a more satisfying insurance experience. Frequently Asked QuestionsWhat does dog pet insurance typically cover?Most dog pet insurance plans cover accidents, illnesses, surgeries, and emergency care. Some plans also offer coverage for routine care, dental procedures, and alternative therapies. Are pre-existing conditions covered by dog insurance?Typically, pre-existing conditions are not covered by dog insurance plans. However, some insurers may offer coverage for curable pre-existing conditions after a waiting period. How can I find the best dog insurance provider?Research different providers, read customer reviews, and compare their coverage options, reimbursement models, and customer service reputation to find the best fit for your needs. What should I consider when choosing a dog insurance plan?Consider coverage limits, deductibles, waiting periods, exclusions, and reimbursement models. Evaluate your dog's health needs and your financial situation to make an informed decision. Is dog pet insurance worth the cost?For many pet owners, insurance provides peace of mind and financial protection against unexpected veterinary expenses. The value depends on individual circumstances and the specific coverage chosen. https://www.petinsurance.com/dog-insurance/

Having pet insurance for your dog isn't just about covering costsit's about peace of mind. When your dog needs medical attention, the last thing you want to ... https://www.trupanion.com/

Reimagined pet insurance for dogs and cats. With unlimited payouts and robust coverage, you can access the vet care your pet deserves. Get a free quote! https://www.aspcapetinsurance.com/

One of the most extensive plans on the market ; Accident Only Plan, Yes, No ...

|